Anglo Saxon Gold Mine – Trousers Legs Joint Venture

70% HAW, manager; 30% Gel Resources Pty Ltd

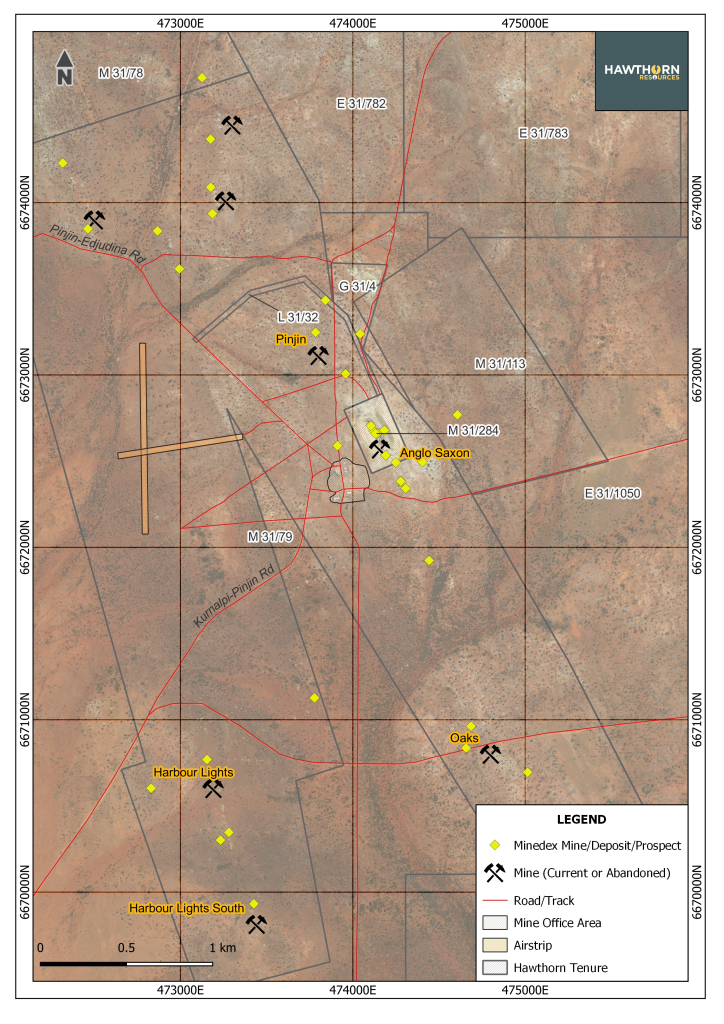

The Anglo Saxon gold mine is located 140 kilometers north east of Kalgoorlie and 35 kilometers east of the Carosue Dam mill operation, formerly Saracen and now part of Norther Star [ASX NST}.

The company was focused on an extensive program of reverse circulation and a limited amount of diamond drilling which enabled the announcement of a Probable Ore Reserve of 730,000 tonnes grading 2.66 g/t gold for 62,000 ounces.

The project received board approval for development of an open pit and construction of haul roads linking into the Carosue Dam network.

A toll treatment agreement, in the form of an Ore Purchase Agreement {OPA} was completed with Saracen Mineral Holdings and site infrastructure established, including a 50 man camp.

Early in 2018 open pit mining operations commenced and the first ore trucked under contract to Carosue Dam for processing. In the financial year 2018 the TLJV had mined 183,731 tonnes high grade and an additional 37,492 tonnes of low grade ore stockpiled on the ROM pad. In financial year 2019 a further 328,166 tonnes of high grade were mined and 115,149 t low grade stockpiled on the ROM pad. Ore haulage in financial year 2018 was 171,721 tonnes and 210,358 in financial year 2019. Ore mining and haulage continued through December 2019 with the final parcels of ore processed at Carosue Dam in the first quarter 2020.

By good fortune for the company, a steady rise in gold price over the operating period enabled the company to report a strong earnings performance for the 2020 financial year of $13,921 million. Note gold price varied from a low of $1,639.29 in August 2018 to a high of $2,220.18 in September 2019. The project evaluation was done at $1,600/ounce.

Operational statistics from Hawthorn 2020 Annual Report:

Ore mined, hauled and processed: 672,595 tonnes.

Average grade: 2.40 g/t

Ounces gold: 49,694.

Average gold price: A$1,890.30

Comparing the pre-mine Probable Ore Reserve of 730,000 tonnes at 2.66 g/t for 62,000 ounces with the above yield of 49,694 indicates a high precision of mine operation for such a geologically complex ore body. If we add the 150,000 tonnes of low grade on the ROM pad the reconciliation is even closer. From drilling we knew the stacked ladder vein quartz lodes varied in thickness both down dip and along strike. Even with close spaced grade control drill holes the modelling of the deposit is difficult.

Additionally the stockpiling of about 150,000 tonnes of low grade on the ROM pad offered the possibility of subsequent treatment at higher gold prices. Consequently in the December quarter last year a study was made of this dump material, using close spaced drill holes. Although variable much of the deeper sulphide ore, the last material mined, was estimated to grade 1.2-1.5 g/t. At the then rising gold price of around $2,500 per ounce a decision was taken to negotiate a toll processing of an initial 50,000t parcel through the Lakewood mill, owned by Golden Mile Milling , in Kalgoorlie. Also a haulage contract was negotiated with a Kalgoorlie based trucking company. Due to mill availability the parcel was modified to an initial 27,000t parcel which was successfully processed confirming the recovered grade at the upper limit of estimates at 1.49g/t.. The balance of this parcel of about 23,000 t will be processed by mid quarter 2022.

Final reconciliation of Gold in Circuit, a standard for all toll milling, is in process and should be completed by mid- March. Following gold sales an analysis of the operation covering all costs will be undertaken and reported. At the current gold price of over $2,600 per ounce this has clearly been profitable. Consideration is now being given for the processing of a further 50,000 t low grade from the stockpile, however at these high gold prices it will likely prove profitable. A decision on this will be made after a full analysis of the initial 50,000 t parcel has been completed.