Rinehart, Modi in private talks as India eyesWA lithium assets

- Australian Financial Review

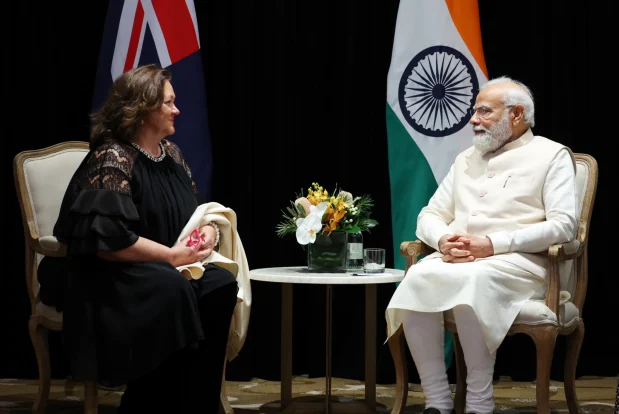

Mining billionaire Gina Rinehart had talks with Indian Prime Minister Narendra Modi in Sydney on Tuesday as his government eyes investments in critical minerals in Australia.

Mrs Rinehart, Australia’s richest person, is a long-time fan of Mr Modi and Indiahas made no secret of its desire to secure lithium assets.

Narendra Modi with Gina Rinehart in Sydney on Tuesday.

The Indian government’s National Mineral Development Corporation (NMDC) was in Western Australia last week, fuelling speculation India is closing in a lithium joint venture with Mrs Rinehart’s Hancock Prospecting.

Speaking to media after the meeting on Tuesday, Mrs Rinehart said India had seen unprecedented economic growth under his leadership and investment-friendly policies.

“The growth recently has been huge, the growth in the future is going to be huge. Australia really needs to work harder to develop its relations with India,” she said. “You just need to look at the investment that has flowed to India from I think about 60 different countries.”

Mrs Rinehart did not comment on any discussions around lithium or other mining projects.

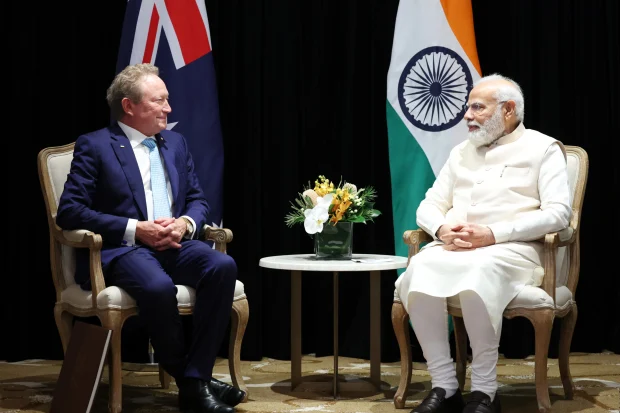

Mr Modi also met Fortescue Metals Group founder Andrew Forrest and Australian Super chief executive Paul Schroder as part of private talks with business leaders.

Indian PM Narendra Modi with Andrew Forrest.

Dr Forrest said his talks with Mr Modi covered opportunities for India in green hydrogen and green iron production as well as humanitarian issues.

Hancock and NMDC are already working together on the undeveloped Mount Bevan magnetite project, about 250 kilometres north of Kalgoorlie, and last August the joint venture partners signed a non-binding agreement in relation to lithium, copper and nickel within the land package.

Part of the Mount Bevan tenements border Delta Lithium’s Mount Ida lithium project, expected to begin production next year.

Delta executive chairman David Flanagan told a mining conference on the GoldCoast last week that Hancock and Chris Ellison’s Mineral Resources had been buying shares in Delta, known as Red Dirt Metals until a name change in April.

The Mount Bevan project is a joint venture between Hancock, NMDC-backed Legacy Iron and Hawthorn Resources, with tenements that cover 165 square kilometres in part of Western Australia that Mr Flanagan refers to a “lithium corridor of power”.

Cut red tape

The broader region includes Liontown’s Kathleen Valley mine, the Mount Marion mine owned by MinRes and China’s Ganfeng, and the Mount Holland mine being developed by joint venture partners Wesfarmers and SQM.

The Modi government, greatly admired by Mrs Rinehart for its efforts to cut red tape, wants electric vehicles to make up 30 per cent of all new car sales by 2030.

NMDC, India’s biggest iron ore miner producing about 35 million tonnes a year for the nation’s steelmakers, has had a majority stake in Legacy for more than a decade.

Hancock bought into Mount Bevan in April 2022 through an earn-in agreement that paves the way for it to own a 51 per cent stake alongside Legacy with 29.4 percent and Hawthorn (19.6 per cent).

Executives from NMDC visited Hancock’s Roy Hill iron ore mine and the company’s remote operations centre at Perth Airport last week. They also had talks with the WA government and lithium producers.

While Hancock bought into Mount Bevan because of the potential to produce higher grade, lower impurity iron ore product, it also sees potential in critical minerals and in particular lithium.

The Mount Bevan joint venture is one of the magnetite projects in the Hancock pipeline. Hancock, through wholly owned subsidiary Atlas Iron, is pushing ahead with approvals for its Ridley project near Port Hedland, which could eventually turn into a multibillion-dollar investment producing 16.5 million tonnes of magnetite a year.

The Rinehart camp has warned the safeguard mechanism – the Albanese government’s flagship emissions reduction policy for heavy industry – could make its magnetite projects uneconomic. It has also urged the government not to curtail coal and gas exports to the detriment of allies like India and Japan.

Speaking at the Queensland Resources Media Club last week, Mrs Rinehart said: “India imports around 50 million tonnes of steelmaking coal each year, and Australia provides about 80 per cent of this.

“India wants to double its steel production by 2030, meaning Australia should ramp up our critical metallurgical coal exports to help our ally.”

Original article: https://www.afr.com/companies/mining/rinehart-modi-in-private-talks-as-india-eyes-wa-lithium-assets-20230523-p5dan9